Iowa 529 Deduction For 2024 Tax Return. Calculate your income tax, social security and pension deductions in. The allowed deduction on qualifying net capital gains for each tax year is identified below:

You must also be eligible to get a tax break, based. Calculate your annual salary after tax using the online iowa tax calculator, updated with the 2024 income tax rates in iowa.

Iowa 529 Deduction For 2024 Tax Return Images References :

Source: beatrixwmoll.pages.dev

Source: beatrixwmoll.pages.dev

Iowa 529 Tax Deduction For 2024 Kippy Merrill, A 529 plan is a.

Source: devondrawletty.pages.dev

Source: devondrawletty.pages.dev

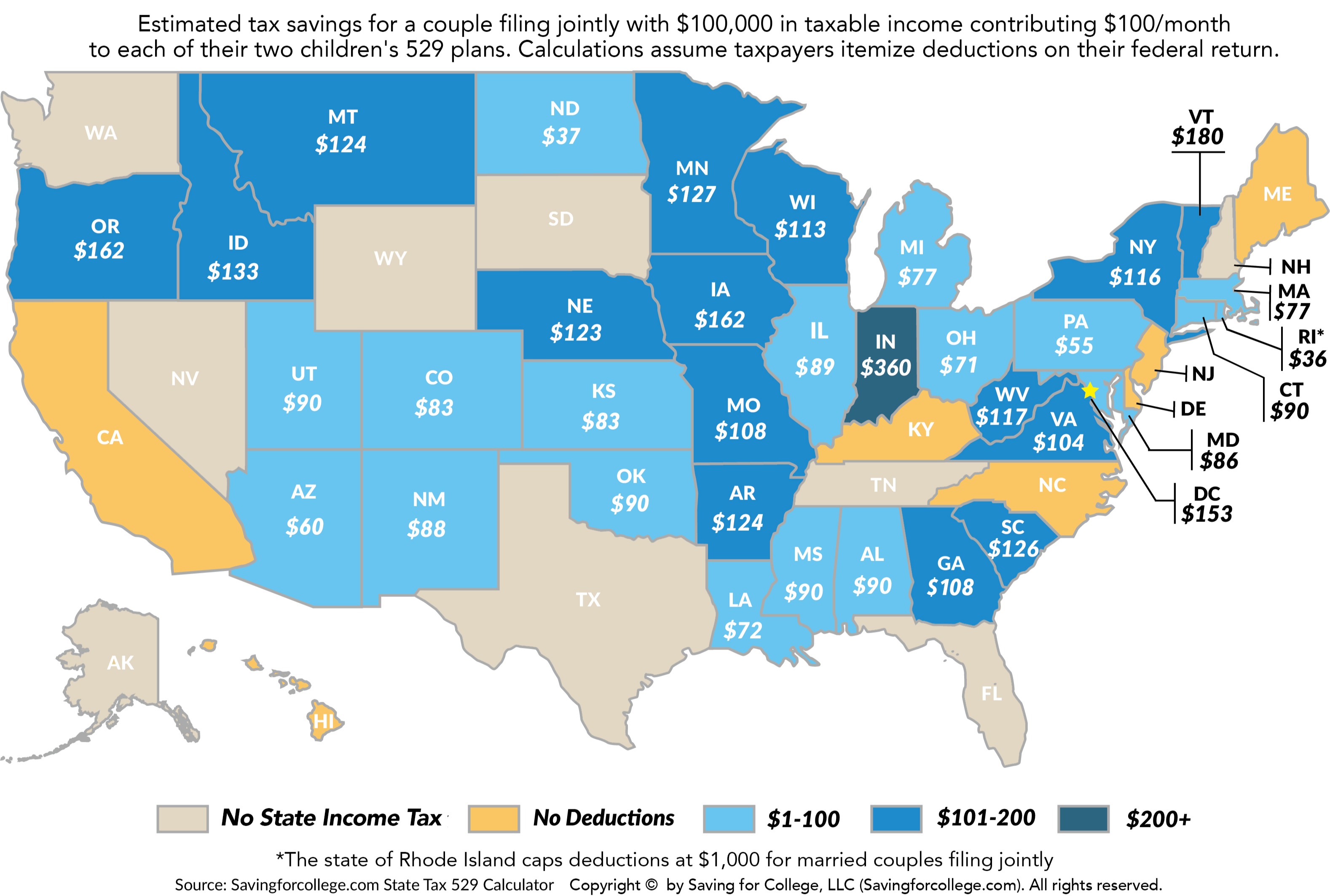

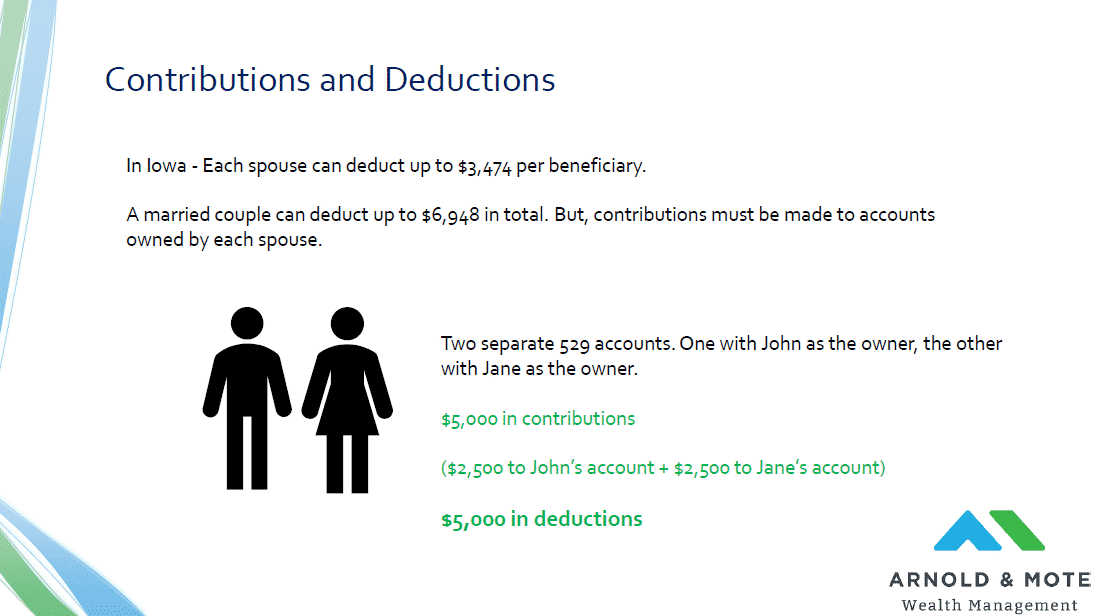

Iowa 529 Plan Tax Deduction 2024 Lotti Rhianon, Iowa taxpayers can deduct up to $4,028 per beneficiary account from their state income taxes in 2024.

Source: paigebdarlene.pages.dev

Source: paigebdarlene.pages.dev

Iowa 529 Deduction For 2024 Anissa Cathrin, On the state return, it only asks me for distributions from a 529 on adjustments to income section.

Source: kelsicinderella.pages.dev

Source: kelsicinderella.pages.dev

Iowa 529 2024 Contribution Paola Beatrisa, However, it is not the only adjustment that is taken into account.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: delbshandra.pages.dev

Source: delbshandra.pages.dev

Iowa 529 Deduction Limit 2024 Mandy Hesther, What is the iowa 529 plan?

Source: paigebdarlene.pages.dev

Source: paigebdarlene.pages.dev

Iowa 529 Deduction For 2024 Anissa Cathrin, In 529 plan tax deduction:

Source: cinderellawashil.pages.dev

Source: cinderellawashil.pages.dev

Iowa Standard Deduction 2024 Asia Mareah, Lowest rates shown include the auto debit.

Source: www.radioiowa.com

Source: www.radioiowa.com

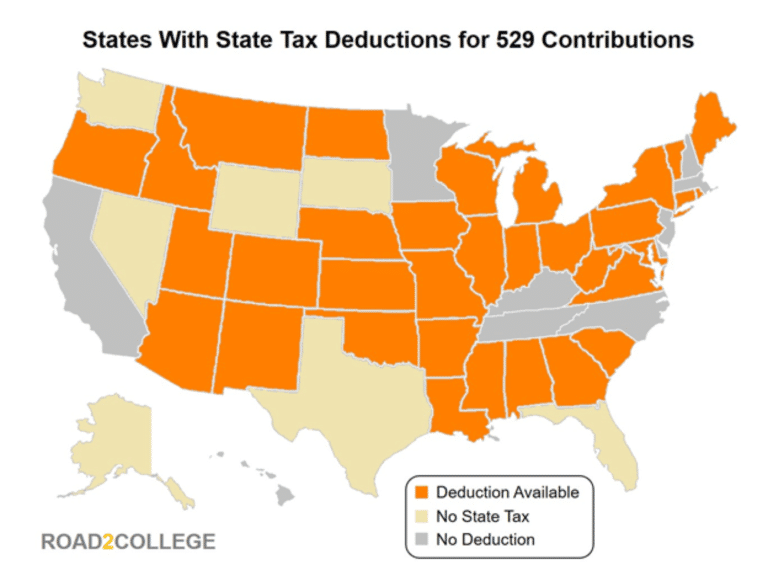

Higher tax deduction for Iowa's taxfree 529 accounts Radio Iowa, Learn how to claim the deduction and about the plan's other benefits.

Source: kristinwchad.pages.dev

Source: kristinwchad.pages.dev

Wi 529 Tax Deduction 2024 Perle Wilone, That’s 22% higher than what was allowed this.

Source: inezceleste.pages.dev

Source: inezceleste.pages.dev

Iowa 529 Plan Deduction 2024 Lia Tandie, 529s will continue to offer great.